Centralised investment propositions – the growing need for a tailored strategy

Expert: David Hutchins, Alliance Bernstein

Facilitator: Richard Parkin, Richard Parkin Consulting

Background

Centralised investment propositions (CIPs) are a core part of most advice propositions. They allow advisers to deliver a consistent investment experience across their client base. They also allow advisers to access economies of scale and so lower the overall costs to clients as well as manage the business risk of having individual advisers recommend different investment strategies.

An argument that is sometimes made against CIPs is that they don’t always allow for the investment approach to be tailored to a client’s needs. Aegon’s Retirement Advice in the UK report found that 41% of advisers surveyed had no intention of adopting a centralised retirement proposition. Of this group, over 80% said the main reason for this was that they preferred to tailor advice to the specific needs of the client.

So, is it possible to access the benefits of a CIP while still providing some flexibility to tailor for individual client needs? Alliance Bernstein has been delivering tailored investment solutions to institutional clients for many years and believes there is scope to bring some of these capabilities to the adviser market to help meet this challenge.

David put forward two concepts of how this could be delivered:

- Custom discretionary investment proposition: This is a CIP designed specifically for the adviser firm creating a series of risk-rated multi-asset portfolios that reflected the advice firm’s specific preferences. These might include the firm’s investment beliefs, their policy on ESG and any specific requirements or exclusions they wanted to apply. While all clients would use the same set of portfolios, these would perhaps more closely reflect the firm’s own requirements than simply using standard models provided by a third party.

- Advisor centralised investment proposition: This uses a similar framework to the above to create a set of portfolios that are tailored to the firm’s needs but allows further variation to reflect an individual client or adviser’s preferences. This might be to include a specific fund, match specific cashflow needs or reflect a personal preference on ESG or similar. This tailored portfolio would then be optimised and managed to ensure it met the overall risk/return and other characteristics the firm had set.

David likened this latter approach to buying a new car. Purchasers can tailor the base model to suit their specific preferences but in a way that still has the underlying performance and safety features of the original design.

The discussion

We started by considering what the main business benefits for advice firms are of offering a CIP. Participants were asked to choose the top three reasons from a list of six benefits. The biggest benefit adviser firms see from using CIPs is managing business risk. While it was recognised that having the same portfolios across all clients did carry some risks (ie if the CIP underperformed then all clients would suffer), participants felt it was still preferable to have consistency and to focus on ensuring the core investment design process was well managed. It was also pointed out that regulatory expectations are that firms will have a well-designed and documented investment approach and again this points towards using a CIP.

A number of firms made the point that the CIP wasn’t just a single set of portfolios. Firms might have different portfolios for those with a preference for ESG-aware investment strategies, or use a different set of portfolios for retirement income. One participant described their CIP as a set of “swim lanes” with each “lane” having a different investment proposition to meet specific client needs. This might include a multi-asset range, a DFM option and a more specialist approach. In this way they can better tailor the investment solution to a specific client’s needs even though they are using a consistent set of solutions in each swiim lane. Thinking of a CIP as a single set of portfolios is overly simplistic.

Next, we looked at what the main benefits of a CIP are to the end client.

The point was made that clients are generally disinterested in exactly how the investment proposition works but are very focused on what it means in terms of outcome and their ability to achieve their objectives. We discussed whether the risk-rated fund approach was sufficiently flexible to accommodate the variability of client needs in retirement. A couple of participants made the point that risk should be considered relative to the client’s objective rather than just at the investment fund level. While different organisations might use different fund risk ratings, what was more important was how the fund supported the client’s ultimate objective.

We had a couple of participants who worked for ratings agencies in the audience and asked them the extent to which they differentiated between accumulation and decumulation when rating funds. Both firms said they didn’t differentiate, preferring to focus on the core characteristics of the fund and leaving it to advisers to determine how to best use the rated funds to meet individual client needs.

It was also suggested that firms should segment clients not by average wealth or fee potential but by their needs. This would allow firms to better assess the extent to which they were achieving the best outcomes for clients.

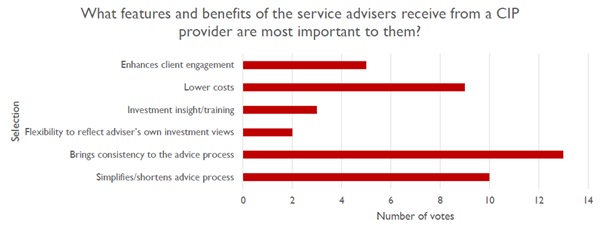

The final question we considered was the benefit that CIPs offer the individual advisers working with clients.

Overall, the benefits to individual advisers are similar to those for the advice firm as a whole. Interestingly, it was generally felt that allowing individual advisers to tailor the investment approach went against the whole rationale for CIPs.

Conclusion

Overall, our participants felt that centralised investment propositions brought significant benefits to the firm, its advisers and, most importantly, its clients. There seemed to be little appetite to tailoring individual solutions for clients, but firms will want to have a range of solutions in their CIP to meet a variety of client needs and will invest significant effort in ensuring that the CIP is comprehensive and well designed and managed.

Overwhelmingly, firms felt it was most important to focus on understanding the client need and then choosing the solution from the CIP that best met this need rather than trying to tailor portfolios for individual clients. By doing this firms are best able to deliver the outcomes that clients want while managing the efficiency and risk within their own businesses.