Business Purpose/Brand Authenticity: Why financial services need to demi

Experts: Isabel Kelly, Profit with Purpose

Iyas AlQasem, Beyond the Quarter

State of play:

Speaker presentations

A. What is driving our focus on ‘purpose’?

- A combination of three forces:

- Regulatory pressure

- Commercial imperative –studies show purposeful firms are proven to be more profitable

- Societal and environmental pressures – from our children, teams, employees, ourselves

B. From philanthropy to purpose; from ‘words on walls’ to strategy in action

Purpose = the ‘S’ of ESG

- Purpose enables firms to better respond to employees and customers

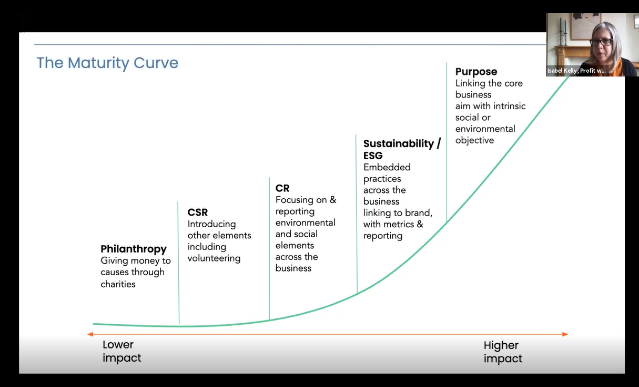

- Firms are at different stages of the maturity curve

Research for the Said Business School 2015 – 2018 showed emerging best practice. Interviews with 25 firms showed three areas firms need to prioritise to thrive and survive:

- technology

- innovation

- finding purpose beyond profit: the ‘purpose pivot’.

Firms that do this well tend to have a specialist team reporting into the CEO/C level with the whole business held responsible. You need long and short-term goals, with a big headline metric. And you also need shorter term metrics to show progress along the way.

- Often these are aligned to the SDGs – there is no one framework that anyone is using

- Your non-financial reporting should sit alongside other reporting: this is now the law on environmental impact, but should be the law on social reporting as well

- Use technology to track impact over time (a holy grail) and progress towards your big goal

- Regulation – some firms are keen to get ahead of what regulators may soon require

Reflection point: Which firms do this well? Where are you on the maturity curve?

C. Key principles

Wherever you are, whatever your size, purpose and values cannot just sit on your ‘About’ page – you will underperform.

The National Bureau of Economic Research studies found a clear correlation between values and performance (using a variety of performance metrics). Key findings include:

- a clear correlation – but significantly, the values could be any values

- “correlation” = integrity - being true to your values (whatever they are) with behaviour that drives your performance

- the reverse is also true: it’s better not to articulate at all, than to articulate and do nothing

D. Mobilisation – the how

There are typically five key stages firms need to go through:

- Articulation: A company ‘aligns’ when the firm knows its purpose, sets its direction and lays out its values- and then empowers individual teams to make decisions they need to make to achieve it, without micromanagement.

- Leading: Walk the talk – statements made by leaders who then fail to live up to them break credibility and trust.

- Embedding: Firms should map how our purpose relates to our customers, stakeholders, owners, community and functions within firms should map how the firm’s values map onto what their function actually does.

- Employment and reward: Firms should stop looking for cultural fit and start looking for values alignment – the quality of employee who really powers performance.

- Engagement: Story-telling and company ‘lore’ are important; stories that really show how we lived up to our values (even if it didn’t seem like it at the time).

Open Forum

In my experience:

Inequality and what FS can do about it

- The rich have their savings tethered to a faster horse; that will widen inequality of wealth over time.

- We must persuade the less rich to use savings more wisely but not preach – not sell gruel with vitamins – that will not work.

- It’s a marketing problem – we have a great set of products, a wall of consumer savings, they’re well priced – but how do you bring that to market?

- Other industries use marketing campaigns to sell ‘boring stuff’ – online gaming is selling a definitively net sum game – whereas we go out with ‘do it because it’s good for you’.

- The regulatory side is not insurmountable if the industry got its act together around co-investment and more imaginative solutions.

In my experience:

It’s an ongoing challenge

- We have defined our purpose; we have a whole package of CSR activities; we very much welcome diversity.

- Responsible investing and ESG made the debate even more critical: you can’t offer something that proposes to be good unless you are a ‘good’ company.

- That led to whole review of our whole estate, which brings challenges internally about what’s good for clients, community, shareholders, all stakeholders.

- Some say we are in the business of “making the rich richer” – the K curve recovery.

- But what we can do is support CSR including social mobility.

- And it’s hard. Our D&I survey shows some of our staff think we’re fantastic, some don’t, with a very wide spread of responses.

In my experience:

We need to engage and educate next gens

- We’ve articulated well the industry-level challenges of perception and engagement.

- Most of us look after the relatively well off and typically slightly older generations.

- But there’s a large proportion of society which is hopelessly under-educated about compound interest, credit card charges, under saving for pensions/retirement etc.

- There’s also a generation rolling off generous final salary pensions and at the same time, a time bomb of people only starting to realise they haven’t saved enough for retirement.

- And we need to engage the next generation – not just the next generation but the one after that – to apply capital in ways that do good.

- It’s amazing and worrying how 20-somethings are risk averse when the chances of a good return on cash over 30 years is microscopic.

- We need people to understand the importance of investing, taking risk and using that risk capital to support companies that are doing good things.

In my experience:

We need “wealth management” for everyone

- The clue is in the title – we’re wealth managers – but that should be for everyone, not just for the wealthy.

- Firms with clear objective / purpose/ principles are organisations people enjoy working for and which deliver results for all.

- Do not assume that the public sector is better at this: charities do not own the moral high ground.

- Purpose is a challenge to all organisations to raise it up a level to rethink ‘why do we exist?’

In my experience:

Let’s learn good lessons from the past

- Our firm has always taken it as our responsibility to work with clients in partnership and have the debate around a variety of issues: ESG, philanthropy etc – and to create a community that works as a ‘reckoning force’.

- We should all remember that the founders of wealth management were wealthy families and philanthropists: change agents, not just entrepreneurs.

- Sadly, financial services has moved very far away from that and certainly doesn’t have that reputation.

- But we believe you have to have the debate and we do that a lot, through public discussions as well as actively asking clients how they think about these issues and creating portfolios that address that.

- Many firms are revisiting what their founders said. Re-looking at it and bringing it forward: the historic rationale were benign; the wealthy frequently founded charities and a lot of firms see value in bringing that value of their ‘tradition’ to the fore.

- Everyone is learning; nobody has it figured out. We all need to co-create it. But important to have the discussion of different points of view, specifically about investments.

- It’s fine to talk about purpose from the inside, but what about the outside-in view investors need to take? What criteria and framework can you objectively apply? How do you assess firms from the outside and decide who to invest in?

In my experience:

We need impartial impact accounting to challenge the ‘tyranny of profit’

- Sir Ronald Cohen has nailed it and his lectures are worth a listen.

- We are at the same moment we were in 1929 when the population cried out that no longer should firms submit accounts their ‘conscience dictates’ – leading to the 1933 US mandate.

- We need to see the creation of impartial ‘impact accounts’.

- In economics/development economics, when you give aid, it’s so carefully analysed, whereas a lot of impact and ESG bold claims are made without viable proof.

- Impact reporting needs to move same way profit reporting has, if people are going to believe corporate sector’s ability to deliver on our promises and purposes.

- Auditors are very interested in doing this – but it has to come from the official/public sector: must be mandated if we are to challenge the ‘tyranny of profit’

In my experience:

Measurement matters

- Measurement and metrics need a three-way coalition: business, non-profit and government (although in non-profits nobody agrees about anything!).

- At least the 17 UN Sustainable Development Goals have agreed targets but must be a three-way coalition to mitigate vested interests and the complexity of multiple resources and inputs.

- But we can’t wait until the metrics are agreed.

- SDGs are the best framework we’ve ever had yet companies get into a state of inaction because they don’t know what the metric should be.

- Firms lose really good strategic objectives because they believe they can’t measure them and have sub-standard goals just because they know they can be measured.

- We need to get to recognised metrics but not let their absence inhibit progress.

- We need to be able measure in less formulaic ways. Other forums have discussed how new elements could be included with financial reporting but sadly concluded if it’s meaningful it’ll already be in there – and nobody wants to add waffle to the annual report. That doesn’t mean firms should not act.

In my experience:

Good culture = good investment

- Leaders will be nervous of strategic objectives they can’t measure or report on.

- And you need to be able to communicate it otherwise it won’t have the desired effect.

- From an investor’s perspective we’re desperate to understand what the culture is in a firm, which is the result of its purpose and the extent to which they’ve gone through those five stages: we think a good culture = a good investment.

In my experience:

Education, reputation, perception

- We need the school curriculum to teach base line probabilities, compound interest - how to help people with financial wellbeing; and beyond that how to interpret ‘false’ news – that’s a public sector role.

- It’s also an industry problem of perception – the age-old reputation of banks versus other financial services providers; banks haven’t quite realised the ongoing damage that their trust deficit continues to do.

In my experience:

Seize clients’ own sense of the purpose of their wealth

- Purpose matters at the client level – many high net worth individual clients are entrepreneurs who never expected to get to this point of wealth.

- It can positively surprise them if you sit them down at that first meeting and instead say

What is all of this for – how do you want to be remembered?

Have you thought how much you could screw your kids up if you leave them this money?

- That can be incredibly interesting and incredibly interesting from their point of view.

- We need to ask clients what ultimately are you trying to do; help clients define the purpose of their wealth.

- Many have created wealth and want to preserve it, in order to invest in other things; usually with a purpose; sometimes with a philanthropic element. Big industrialists are frequently interested in green technology and in furthering more socially purposeful ventures.

- We hold events focused on philanthropy and we see a real appetite from clients who want to do this well, so that it counts – at micro level - then build it from grass roots level.

In conclusion

Key points to remember

- There is no destination. We are all always on a journey – purpose and values are never done; we are never ‘there’.

- Once articulated, break it down. Use your stakeholder map and think how does my purpose align with that part of my stakeholder map?

- Then prioritise. Make three things happen where you’re going to make the biggest dent.

- Be cheerful! Cracking articulating your overarching objective is a huge relief; it frees you from multiple tactics with no reputational benefit if you know ‘this is the end goal we’re looking to achieve’.

- Clarity can also mitigate risk. See for example Firm D - automation.

Key reflection points

- We could consider what we can do as an industry to fix these issues?

- We could articulate better the over-arching purpose of wealth management?

- We could each consider our own legacy: how we want to be remembered, even if we ourselves are forgotten.

And some examples we looked at along the way:

Firm A - Credit scoring

- Set the big metric of focusing on financial health

- Wanted to get their products into communities that don’t traditionally use them – but how?

- Established a headline metric of moving people and communities from unbanked, to banked: everything then flowed from this overarching objective.

- Looked at who reached the people they wanted to deal with.

- The CSR team showed their work was entirely aligned with the firm’s business objectives, not to service the profit making but to reach a wider audience: they own the relationships with not for profits that reach into communities that marketing typically cannot.

- This is an audience who can’t realise their dreams because their credit rating is against them and who traditional marketing does not reach.

- This firm understood the value of its relationship with community organisations, and as part of trusted partnerships rather than ‘computer says no’ HQ

- Their ‘by boat and bus’ approach created a totally different way to access their audiences.

- It’s about

- alignment to your objectives – with incentives for everyone

- clarity - part of your purpose is how you serve society

- the relationship between purpose and strategy – strategy is guided by purpose

Firm B - Insurance

- Plain talking – ‘what we do’ and guiding principles: we help people to reduce the risk of things going wrong and help them put it right when they do

- This directly translates to insurance products AND strategic direction

- It also illuminates thinking about the under-served: those without access, knowledge, education about finance and the impoverished: those who are both under and over insured. These people don’t have the insurance they need but rather 3 – 4 policies that cover the same things: they over pay, under benefit.

- The education process of speaking with communities about what insurance actually means (not always an appealing product)– translated into education programme.

- And the corporate strategy fits in line completely with the firm’s ESG purpose

Firm C - Data technology platform

- This firm had a very dynamic leadership vision that was refreshed every year, focused on never plateauing on technology

- The social impact team had to align with that overarching vision – and it became harder when vision became simply ‘become an $Xbn firm’

- But even if the ‘purpose’ was purely profit, the team focused on ‘how are we contributing’ through the work we do to serve our community and make our firm an aspirational employer of choice.

Firm D - Automation experts

- This firm was aware of general concern of robots replacing humans in the workplace.

- So, they addressed that in their purpose with an outcome focused on inspiring the future of work. In other words, they specifically addressed negative associations in their core purpose and flipped this to a positive part of their purpose an active area of focus.