In the run up to this Meeting of Minds, we asked you to answer some questions – our goal being to capture your thinking at a moment in time. The following are your aggregated responses. We hope you find this snapshot interesting as well as reassuring – in other words your peers are experiencing the same challenges and excitements as you are!

Bank & Brand Distribution of Retail Financial Services

SCENE-SETTER QUESTIONNAIRE FINDINGS

Thursday 13 October 2016, The Berkeley Hotel, London SW1

Contents

How do you feel?

1. What are the biggest issues facing your business / industry?

2. How do you feel about the year ahead on a scale of 1 - 10 (with 10 being your most positive

frame of mind possible)?

3. If you were in charge of the regulator for the day, focusing on your own sector, what do you think should

be at the top of the in tray?

Your business model & partnership strategy

4. Who’s in the room – business models represented at A Meeting of Minds

5. How did your business numbers change over the past year?

6. How do you expect your business numbers to change over the next year?

7. Where Financial Services is not your core business, please describe your current approach to your

involvement in financial services?

8. How does your Board view the company's involvement in financial services?

9. How many product providers you work with?

10. What is the main motivation behind your partnership strategy?

11. Are you looking to grow your product range?

12. How many potential financial services customers does your organisation have?

13. Do you segment your customer base?

4. If yes, how do you segment?

15. Product partnerships under the microscope

The future

16. Predicted future change in each product area

17. How do you see different sectors growing/consolidating in terms of their involvement in financial services over the next 1-3 years?

How do you feel?

1. What are the biggest issues facing your business /industry?

The following key issues were put forward and have been grouped in priority order:

1. Keeping pace with the digitalrevolution

- Innovation

- Updating technology in a fast movingenvironment

- FinTech

- Technologicaldevelopment

- Technological paymentadvances

- Diversification of advertising spend, eg, social media, digitalmarketing

- Declining printaudiences

2. Regulatory change and rden

- Scale and frequency of regulatorychanges

- Changes within the regulatory environment creating further restrictions for thesector

- Regulation, governance andlegislation

- We regulate the wrongbehaviours

3. Evolving businessmodels

- Alternative businessmodels

- Disintermediation

- Marketconsolidation

- Increasedcompetition

- Productdifferentiation

- Challengerbanks

4. Changing consumerbehaviours

- Trust - consumer confidence at a low as a result of economic uncertainty impacting decisions toborrow

- Consumers not understandingadvice

- Lack of consumerengagement

- Understanding the needs and wants of over50's

- Disinterestinanoverlycomplexsubjectwithalongtermrewardandlittleinitialupsidebytheconsumer

5. Geopolitical

- The changing politicallandscape

- Bank ofEngland

- Economicenvironment

- EU Referendum, Brexit and the associatedimpacts

6. Other

- NHSfunding

- Threat to the future of theNHS

- Retaining youngerdoctors

- Socialinequality

- Housingsupply

- Food pricedeflation

2. How do you feel about the year ahead on a scale of 1 - 10 (with 10 being your most positive frame of mind possible)?

1. How do you feel about the year ahead on a scale of 1 - 10 (with 10 being your most positive frame of mindpossible)?

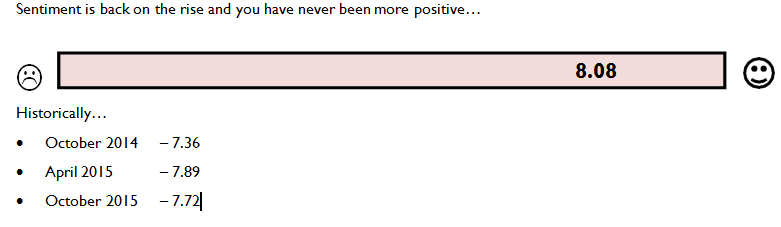

Sentiment is back on the rise and you have never been more positive…

2. If you were in charge of the regulator for the day, focusing on your own sector, what do you think should be at the top of the intray?

Here are some of the comments made. In essence, there should be greater focus on getting to know customer and delivering simpler, proportional regulation.

· It’s all about thecustomer

o Meeting thecustomer

o Getting to know MrsMiggins.

o Understanding consumers'expectations.

o Analyse the overall effect of all of their recent changes on both customers andbusinesses

· Simplifyingregulation

o Make it simpler for the customer tounderstand

o How can we reduce or possibly removeregulations?

o Simplifying regulation and application of regulation and costs of doingbusiness

o Proportionality of regulation according the risks posed by a simple savings and lendinginstitution

· Other…

o Understanding the differences between the different sizes of organisation and the potential threats and opportunities this presents both to the industry but to the market ingeneral.

o There should continue to be a focus on those running financial organisations and their capabilities and strategies to ensure longer termsustainability.

o Communication and co-ordination with government andbanks

o One of the biggest challenges banks are facing nowadays is their hardcoded system which is too rigid. How can we make banking more flexible to adapt to its target market? How will it use and implement technology to best customers'needs?

o Regulation for peer to peerfunding